adidasultraboostsneakers.site

Overview

Everything You Need To Know About Refinancing

Your Financial Goals Should Be Clear · You Can Refinance to Get Cash · You Can Shorten Your Loan Term · You Can Lower Your Payments · You Can Remove PMI When You. What You Should Know About Refinancing. What is Refinancing? Refinancing is a process in which you pay off one or more existing debts with a new loan. If you. While refinancing your mortgage—replacing your current mortgage with a new one—can save you thousands of dollars, eliminate years of high interest rates, and. You may wish to refinance an existing home to take advantage of changes in interest rates, to unlock some of the equity on your home, or to reduce your. 9 Things to Know Before You Refinance Your Mortgage · 1. Your Home's Equity · 2. Your Credit Score · 3. Your Debt-to-Income Ratio · 4. The Costs of Refinancing · 5. A refinanced loan probably translates to a longer term, even at a lower rate and smaller payment. This means you'll pay interest much longer than the initial. You'll need to check your loan's terms regarding the prepayment penalty period and penalty amount. If you'll incur a prepayment penalty, be sure add it to the. When you refinance, you're applying for a new mortgage. That means you'll need to apply for the new mortgage, let the lender verify your credit score and. You'd want to do it because the new loan should be at a lower interest rate than the original loan, so you'd end up paying less money overall. Your Financial Goals Should Be Clear · You Can Refinance to Get Cash · You Can Shorten Your Loan Term · You Can Lower Your Payments · You Can Remove PMI When You. What You Should Know About Refinancing. What is Refinancing? Refinancing is a process in which you pay off one or more existing debts with a new loan. If you. While refinancing your mortgage—replacing your current mortgage with a new one—can save you thousands of dollars, eliminate years of high interest rates, and. You may wish to refinance an existing home to take advantage of changes in interest rates, to unlock some of the equity on your home, or to reduce your. 9 Things to Know Before You Refinance Your Mortgage · 1. Your Home's Equity · 2. Your Credit Score · 3. Your Debt-to-Income Ratio · 4. The Costs of Refinancing · 5. A refinanced loan probably translates to a longer term, even at a lower rate and smaller payment. This means you'll pay interest much longer than the initial. You'll need to check your loan's terms regarding the prepayment penalty period and penalty amount. If you'll incur a prepayment penalty, be sure add it to the. When you refinance, you're applying for a new mortgage. That means you'll need to apply for the new mortgage, let the lender verify your credit score and. You'd want to do it because the new loan should be at a lower interest rate than the original loan, so you'd end up paying less money overall.

No cash-out refinance · Lower your mortgage rate. If mortgage rates are lower than when you closed on your current mortgage, refinancing could reduce your. As we know, there are many different mortgage packages available in the market today that cater to just about every need when it comes to refinancing a mortgage. If interest rates have dropped since you obtained your current mortgage, refinancing can help you secure a lower rate, potentially saving you a significant. As with most loans, they consider your credit score and payment history as well as your income and debt levels. Before refinancing, you may want to know your. Refinancing a home or mortgage has costs and fees associated with it that can add up depending on the loan amount, property location and other factors. A refinance occurs when a business or person revises the interest rate, payment schedule, and terms of a previous credit agreement. You want to tap into your home's equity to meet another financial goal. Cash-out mortgage refinancing can be an effective way to finance home repairs, pay off. What should you know before you refinance the loan on your house? · How much equity you have in your home – the more the better. · Your credit score – higher. Refinancing, in the simplest terms, is when you take out a new loan to pay off an existing one. This can be done for various reasons including changing the. What decrease in rate is enough to consider refinancing? Generally, if you can get a rate that is at least one to two percent less than your existing rate, you. You also need to have a clear idea of how you'll use the money you free up when you refinance. This is particularly true if you plan on cashing out your equity. Cash-out refinances are a helpful way to secure the capital you need to renovate your home on a new, low-interest mortgage. What is Refinancing? Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments, lower your interest rates, take cash out of. And how is your credit? The answers will determine what kind of loan you can qualify for and whether or not you'll need to get mortgage insurance. Do you have. Cash-out refinance: This is when homeowners want to cash out on some of their home's equity. You'll refinance the remaining loan balance, plus the additional. Can you afford the closing costs? Refinancing typically requires closing costs which could be in the thousands. Lenders may offer no-cost refinancing but they. Refinancing may remind you of what you went through when you got your Consider refinancing only if you can meet an important financial goal. Below. To find out what you qualify for there are common factors taken into consideration by any lender, even your bank. Things like your credit score, gross annual. Everything you need to know about refinancing There comes a time in the life of most homeowners when a drop in prevailing interest rates coupled with the. Research Lenders – While some borrowers may prefer the simplified option of securing their refinance loan through their existing mortgage lender, different.

How To Improve A Good Credit Score

The longer your credit card accounts are open (and in good standing), the better it is for your score. This includes accounts you no longer use and those with a. What factors impact your credit score? · Pay your bills on time, every time. · Pay off your debts as quickly as you can. · Keep your credit card balance well below. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Want a good credit score? · 1. Payment history, 35% · 2. Amounts owed, 30% · 3. Credit history length, 15% · 4. (tie) New credit, 10%. Check your credit report. · Pay your bills on time. · Pay off any collections. · Get caught up on past-due bills. · Keep balances low on your credit cards. · Pay off. Applying for credit · Compare your credit options · Compare your credit options · Use eligibility checkers before applying · Use eligibility checkers before. What's a good credit score? There's no single answer to what a good credit score is. · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4. The longer your credit card accounts are open (and in good standing), the better it is for your score. This includes accounts you no longer use and those with a. What factors impact your credit score? · Pay your bills on time, every time. · Pay off your debts as quickly as you can. · Keep your credit card balance well below. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Want a good credit score? · 1. Payment history, 35% · 2. Amounts owed, 30% · 3. Credit history length, 15% · 4. (tie) New credit, 10%. Check your credit report. · Pay your bills on time. · Pay off any collections. · Get caught up on past-due bills. · Keep balances low on your credit cards. · Pay off. Applying for credit · Compare your credit options · Compare your credit options · Use eligibility checkers before applying · Use eligibility checkers before. What's a good credit score? There's no single answer to what a good credit score is. · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Tips for increasing credit score more quickly · Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate. 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4.

5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. Three ways to raise a credit score quickly are to pay off outstanding debts, ask for an increased credit limit and become an authorized user on someone else's. Plus, the presence of the loan or HELOC on your credit report could improve your mix of credit, which accounts for 10% of a FICO score. It's a good idea to. Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep old accounts open. Having good credit helps you get better rates on mortgages, car loans and other debt products, and may affect your ability to rent an apartment or sign up for. Improving Your Credit Score · A. Get a Copy of Your Credit Report. You can get a credit report from each of the big three credit bureaus (Experian, Equifax, and. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. Develop a good credit score, about build a budget, establish good credit, tackle overspending, DePaul Shortcuts, Academic Resources. Pay your cards off times per month instead of once per month to keep your balance low at any one time. If you make a major purchase, pay the card off right. Here are some tips: Build credit history that benefits you: Open store charge card or credit cards to build credit. Pay your balance in full each month or keep. Establishing good credit habits is essential so that you can build and improve your credit history and credit score. Keep paying your bills on time. In many credit scoring formulas, your payment history has the greatest effect on your overall credit scores. So, it's critical. Increase your credit line: If you have credit card accounts, call and inquire about a credit increase. If your account is in good standing, you should be. The fastest way to improve your credit score is to stop using your credit cards and pay down the balance on each and every one. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score. But some actions might have an impact on your. Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if you've been a good. Keep your credit utilization level below 30%: Zero is better. But if you can't manage that right now, 30% or less is a good target to aim for in the meantime. 10 Ways to Improve Your Credit Score · 1. Pay your bills when they're due. · 2. Keep credit card balances low. · 3. Check for errors. · 4. Make a plan to pay down. There are simple ways to fix that. · Pay your bills on time. That goes for ALL your bills – not just credit cards and loans. · Keep your credit card balances low.

Application Specific Integrated Circuit For Mining

An application-specific integrated circuit is an integrated circuit (IC) chip customized for a particular use, rather than intended for general-purpose use. Bitcoins Miner 1TH/S Solo Miner LV07 SHA Asic Chip Low Noise Lottery Crypto Miner G WiFi 25W Bitcoins Mining Machine Home Use ICERIVER KS0 Ultra Gh. ASIC miners, or Application-Specific Integrated Circuits, are pieces of hardware that are specifically designed for one particular use, rather than for a. Application-specific integrated circuit (abbreviated as ASIC) is an intergrated circuit (IC) customized for a particular use, rather than intended for general-. This blog delves into cryptocurrency mining and explores the top ASIC (Application-Specific Integrated Circuit) miner manufacturers. These. ASIC Mining. Many miners now use custom mining machines, called Application-Specific Integrated Circuit (ASIC) miners, equipped with specialized chips for. ASIC (Application-Specific Integrated Circuit) definition: A specialized, intensive hardware device designed for mining cryptocurrencies like Bitcoin. ASIC miners are specialized devices for cryptocurrency mining, known for their high efficiency and performance, pivotal in the competitive mining ecosystem. ASIC (Application-Specific Integrated Circuit) definition: A specialized, intensive hardware device designed for mining cryptocurrencies like Bitcoin. An application-specific integrated circuit is an integrated circuit (IC) chip customized for a particular use, rather than intended for general-purpose use. Bitcoins Miner 1TH/S Solo Miner LV07 SHA Asic Chip Low Noise Lottery Crypto Miner G WiFi 25W Bitcoins Mining Machine Home Use ICERIVER KS0 Ultra Gh. ASIC miners, or Application-Specific Integrated Circuits, are pieces of hardware that are specifically designed for one particular use, rather than for a. Application-specific integrated circuit (abbreviated as ASIC) is an intergrated circuit (IC) customized for a particular use, rather than intended for general-. This blog delves into cryptocurrency mining and explores the top ASIC (Application-Specific Integrated Circuit) miner manufacturers. These. ASIC Mining. Many miners now use custom mining machines, called Application-Specific Integrated Circuit (ASIC) miners, equipped with specialized chips for. ASIC (Application-Specific Integrated Circuit) definition: A specialized, intensive hardware device designed for mining cryptocurrencies like Bitcoin. ASIC miners are specialized devices for cryptocurrency mining, known for their high efficiency and performance, pivotal in the competitive mining ecosystem. ASIC (Application-Specific Integrated Circuit) definition: A specialized, intensive hardware device designed for mining cryptocurrencies like Bitcoin.

These hardware are designed with the sole intention of mining Bitcoin (or other cryptocurrencies). There are some coins that cannot be effectively mined using. ASIC stands for Application-Specific Integrated Circuit, which refers to specialized hardware devices designed specifically for mining cryptocurrencies. Application-Specific Integrated Circuits (ASICs) are at the heart of modern cryptocurrency mining. This category provides in-depth articles explaining what. An ASIC miner (ASIC = Application Specific Integrated Circuit) is a computing machine that is built to handle a type of calculation particularly well and. This eventually led to the creation of powerful mining rigs requiring more robust mining devices known as application specific integrated circuits (ASICs). Currently, the two most popular methods are GPU (Graphics Processing Unit) mining and ASIC (Application Specific Integrated Circuit) mining. Both approaches. mining, Application-Specific Integrated Circuits (ASIC) have ASIC miners, or Application-Specific Integrated Circuit miners, are. The expenses of Bitcoin mining ASIC miners may cost as little as $, while a properly designed mining setup can cost up to $15, It may. The ASIC Miners (Application-Specific Integrated Circuit Miners) are specialized electronic devices used for cryptocurrency mining. Their operation is based. Building an ASIC (Application-Specific Integrated Circuit) miner has challenges and risks. While the potential rewards can be substantial, especially in the. An Application-Specific Integrated Circuit (ASIC) is a microchip designed specifically for mining cryptocurrencies. Unlike general-purpose hardware, ASICs. Application-Specific Integrated Circuits (ASIC) miners are specialized hardware devices engineered for a singular purpose: to mine. In the realm of cryptocurrency mining, an Application-Specific Integrated Circuit (ASIC) miner stands as a cornerstone of efficiency and. Discover ASIC mining: a specialized process for cryptocurrency mining using Application-Specific Integrated Circuits. Learn more about ASIC Mining here. ASICs are the go-to for mining cryptocurrencies like Bitcoin because they're designed to handle the required calculations quickly. Automotive industry. ASIC chip modules find broad applications in various devices such as printers, cryptocurrency mining rigs, defense systems, and other smart terminals. Here is a. Mining ASIC. ASIC, short for Application-Specific Integrated Circuit, refers to hardware specifically designed to perform a particular task. Crafted with a. An ASIC (Application-Specific Integrated Circuit) miner is a specialized hardware device designed for the sole purpose of mining cryptocurrencies such as. Application-Specific Integrated Circuit (ASIC) As the name suggests, ASICs are integrated circuits that have been designed to serve a particular use case, in. Short for application-specific integrated circuit (ASIC), ASIC miners are designed to do one thing and one thing only — mine cryptocurrency. The first ASIC.

Money Saving And Investing Apps

:max_bytes(150000):strip_icc()/androidstocks-acorns-5bda8632c9e77c005100874a.jpg)

Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Giving you freedom and flexibility whilst you save · More convenience - enjoy easy access to your money when you want it. Start investing with just $5! One. Smartphone apps give instant access to trading and portfolio management services, with market access at your fingertips. Explore a wide range of apps, from budgeting and couponing apps to cashback and investment apps, all designed to help you save more and spend wisely. Our guides. Apps and Brokers · Robinhood · Acorns · TDAmeritrade · Merrill Edge · Twine (app for collaborative goals/saving) · Charles Schwab. Acorns helps you save and invest! Invest spare change, invest while you bank, earn bonus investments, grow your knowledge and more. Get started with Acorns. Betterment – Best app for automated investing · Invstr – Best app for education · Acorns – Best app for saving · Wealthfront – Best app for portfolio management. Plum: Smart Saving & Investing 4+. Earn % AER With automated deposits, accessible investing and smart budgeting, Plum gives your money momentum. Plum is the ultimate smart money app, helping over 1 million people to invest, save and manage their spending with automation. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Giving you freedom and flexibility whilst you save · More convenience - enjoy easy access to your money when you want it. Start investing with just $5! One. Smartphone apps give instant access to trading and portfolio management services, with market access at your fingertips. Explore a wide range of apps, from budgeting and couponing apps to cashback and investment apps, all designed to help you save more and spend wisely. Our guides. Apps and Brokers · Robinhood · Acorns · TDAmeritrade · Merrill Edge · Twine (app for collaborative goals/saving) · Charles Schwab. Acorns helps you save and invest! Invest spare change, invest while you bank, earn bonus investments, grow your knowledge and more. Get started with Acorns. Betterment – Best app for automated investing · Invstr – Best app for education · Acorns – Best app for saving · Wealthfront – Best app for portfolio management. Plum: Smart Saving & Investing 4+. Earn % AER With automated deposits, accessible investing and smart budgeting, Plum gives your money momentum. Plum is the ultimate smart money app, helping over 1 million people to invest, save and manage their spending with automation.

For new investors who just want to put their money to work, it's hard to beat the Acorns investment app. With an intuitive, smart design and no deposit minimums. Best investing apps · Best app for automated investing: Betterment · Best app for micro-investing: Acorns · Best app for active investing: Robinhood · Best app for. That means each pay period, before you are tempted to spend money, commit to putting some in a savings account. See if you can arrange with your bank to. Beanstox makes saving and investing easy. Designed by me and our team of experts, to save you time and help your money grow over time. Acorns helps you save & invest. Invest spare change, bank smarter, earn bonus investments, and more! Get started. With Appreciate you can easily invest in US equities, fixed deposits, ETFs, bonds, digital gold, savings accounts and many more lucrative investment products at. Qapital is an award-winning app designed to let you save, invest, and spend with any goal in mind. Saving and investing app” may refer to a variety of different mobile applications that use technology to help you save and invest. These apps are often. 11 Best Investment Apps of · Best for Casual Day Trading: Robinhood · Best No-Nonsense App: Charles Schwab · Best for Mutual Funds With No Minimums: Fidelity. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. Cowrywise is a wealth management app that enables you to plan, save and invest money easily. With direct access to the largest pool of mutual funds in Nigeria. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Money-saving apps allow you to grow your nest egg slowly by putting small amounts of money aside as you conduct your regular financial transactions. Prior. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. Available to both Apple and Android users for just $1 a month, Acorns is essentially an investment app that does all the work for you. Acorns works by rounding. 4. Acorns A premier money budget app, Acorns makes the investing process so intuitive and convenient that it now boasts more than 7 million users. This app. Cost: Free A Singaporean robo-advisory popular for their low fees, Endowus offers a combination of algorithm-driven investing and live advice from human. Budgeting, banking, saving, investing all in one place. Simple The all-in-one money app. Budget. Save. Spend. Invest. All in one incredibly powerful. They've been around longer, and I don't want to worry about the company I'm investing with going under and losing my money. Upvote 3. 2. Acorns: Best for Automated Saving & Investing · Round-ups, which round up and invest the change on every purchase with your connected debit card · Found Money.

Cash Back With

Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. Unlock unlimited cash back. With the PayPal Cashback Mastercard, you'll earn unlimited 3% cash back1 when you checkout with PayPal and % on all other. Looking for a cash back credit card but aren't sure where to begin? Here's our expert summary of the best cash-back credit cards this September. Choose which category you want to earn 3% cash back from the six categories shown below - now with enhanced categories. To change your choice category for. Earn a flat % cash back on all eligible purchases with no annual fee or foreign transaction fees with the Citizens Cash Back Plus™ World Mastercard®. Earn up to 6% cashback from select brands with any Varo cashback card you use. Debit or Believe. So every time you swipe, you're treating yourself. Cash back refers to a credit card that refunds a small percentage of money spent on purchases. You can also sign up through cash-back sites and apps. Redeem cash back deals with your Chime card. You don't need a special cash back rewards card to use Chime Deals. Just tap or swipe your Chime® Visa® Debit Card. Bank of America Preferred Rewards® members earn 25%% more cash back on every purchase. That means you could earn % - % cash back on every purchase. Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. Unlock unlimited cash back. With the PayPal Cashback Mastercard, you'll earn unlimited 3% cash back1 when you checkout with PayPal and % on all other. Looking for a cash back credit card but aren't sure where to begin? Here's our expert summary of the best cash-back credit cards this September. Choose which category you want to earn 3% cash back from the six categories shown below - now with enhanced categories. To change your choice category for. Earn a flat % cash back on all eligible purchases with no annual fee or foreign transaction fees with the Citizens Cash Back Plus™ World Mastercard®. Earn up to 6% cashback from select brands with any Varo cashback card you use. Debit or Believe. So every time you swipe, you're treating yourself. Cash back refers to a credit card that refunds a small percentage of money spent on purchases. You can also sign up through cash-back sites and apps. Redeem cash back deals with your Chime card. You don't need a special cash back rewards card to use Chime Deals. Just tap or swipe your Chime® Visa® Debit Card. Bank of America Preferred Rewards® members earn 25%% more cash back on every purchase. That means you could earn % - % cash back on every purchase.

Mastercard cashback store locator helps consumers find cashback stores near you. Get access to cash at the time of checkout process with your debit. AT A GLANCE. Unlimited % cash back is just the beginning. Earn unlimited % cash back or more on all purchases, like 3% on dining and drugstores and 5% on. Earn extra cash for what you already buy. Load qualifying cash back offers on your card, and transfer cash to your Shopper's Card or PayPal account. Earn cash rewards on every purchase, everywhere when you use your Quicksilver cash back credit card from Capital One. Make Every Purchase Rewarding We help consumers earn millions in cash back with our free app and the promotions we power via the Ibotta Performance Network. TruMark Financial offers the Cash Back Visa® Signature credit card. No balance transfer fees, cash advance fees, nor annual fees. Fifth Third % Cash/Back Card · Apply for the % Cash/Back Card Today: · Current Customer · New to Fifth Third? · Earn Unlimited Cash Back On Purchases. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. American Express Cash Back Credit Cards allow you to earn a percentage of the dollar amount of every eligible purchase, made during each billing cycle. This. With the Consumers Cash Back Mastercard, you can get an unlimited % cash back anytime, on anything - from groceries to gas and everything in-between. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Now with RetailMeNot, you can quickly earn cash back at your favorite stores. Combine with coupons, promo codes, and deals for maximum savings! The money comes from the card company to entice you to use the card. The card company makes money from the shops each time you swipe the card. Easily compare and apply online for the best Cash Back credit cards with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. Shop to earn. Each eligible purchase grants cash back.1 Use your PayPal Cashback Mastercard on PayPal purchases. You'll earn another 3% on top A mobile phone. How to redeem cash back · Statement credit: Apply cash back as a credit to your account balance. · Direct deposit or check: You can often transfer cash back to. Key Cashback® Credit Card You buy more than groceries and gas, so your cashback card should give you more. With the Key Cashback credit card, if you have an. Benefits of Discover cash back credit cards Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year. Our cash back app offers the best features to save on grocery, every day items, and your favorite brands online. 1. Add offers to Your list. Find offers for.

How Do Crypto Wallets Work

The public key is generated by performing a mathematical operation on the private key, and it is used to derive the wallet address associated with the. What Is a crypto wallet, and how does it work? First things first, what exactly is a crypto wallet? In the simplest sense, a crypto wallet is your crypto bank. Crypto wallets are software programs that store private and public keys used to interact with a blockchain network and manage cryptocurrency. Accessibility: Wallets make it easier for users to send and receive cryptocurrencies globally without needing intermediaries. This accessibility is particularly. Cryptocurrency wallets store users' public and private keys while providing an easy-to-use interface to manage crypto balances. How do crypto wallets work? Unlike traditional wallets, crypto wallets don't technically store your crypto—they store your private key. A private key is like. A wallet is a tool (hardware or software) that allows you to interact with a blockchain using public and private keys. A physical wallet is used to store physical currency, however a crypto wallet does not store cryptoassets within it. How can this work? Well, most people. Cryptocurrency hardware wallets work by generating private keys and providing a user with an offline, “cold”, physical space to store and protect these private. The public key is generated by performing a mathematical operation on the private key, and it is used to derive the wallet address associated with the. What Is a crypto wallet, and how does it work? First things first, what exactly is a crypto wallet? In the simplest sense, a crypto wallet is your crypto bank. Crypto wallets are software programs that store private and public keys used to interact with a blockchain network and manage cryptocurrency. Accessibility: Wallets make it easier for users to send and receive cryptocurrencies globally without needing intermediaries. This accessibility is particularly. Cryptocurrency wallets store users' public and private keys while providing an easy-to-use interface to manage crypto balances. How do crypto wallets work? Unlike traditional wallets, crypto wallets don't technically store your crypto—they store your private key. A private key is like. A wallet is a tool (hardware or software) that allows you to interact with a blockchain using public and private keys. A physical wallet is used to store physical currency, however a crypto wallet does not store cryptoassets within it. How can this work? Well, most people. Cryptocurrency hardware wallets work by generating private keys and providing a user with an offline, “cold”, physical space to store and protect these private.

A crypto wallet is really a user interface that allows you to query your cryptocurrency's underlying blockchain for information, receive funds from other users. Receiving works the same way – the sender uses your address, and you accept the payment. Why do you need to protect your crypto wallet? Now that we know the. Crypto wallets do not store your cryptocurrency. Crypto wallets store your private keys. And this private key is associated with a public key, which is used to. For those actively using Bitcoin to pay for goods in shops or make trades face-to-face daily, a mobile crypto wallet is an essential tool. It runs as an app on. Crypto wallets store your private keys and keep your crypto safe and accessible for spending, sending, or saving. Crypto wallets are software programs that store private and public keys used to interact with a blockchain network and manage cryptocurrency. Hardware Wallets: How Do They Work? In blockchain technology, a hardware wallet is a cryptocurrency wallet that stores private keys on a hardware device, such. Instead, crypto wallets store private keys—long strings of letters and numbers—that can be paired with public keys to enable access to cryptocurrency on a. How does a cryptocurrency wallet work? Crypto wallets provide users with an interface on which to invest in crypto and access their holdings. To do so, each. Instead, the wallet saves information and details about your public and private keys, which correspond to your ownership stake in the cryptocurrency. You can. A crypto wallet enables users to send and receive cryptocurrency transactions -- an approach that's similar in concept to how a traditional bank account enables. How do crypto wallets work? When someone sends bitcoin, ether, dogecoin or any other type of digital currency to your crypto wallet, you aren't actually. This wallet can store your crypto keys and give you access to adidasultraboostsneakers.site's decentralized exchange. If you're looking for a regulated exchange to trade on in. These keys are used to sign transactions, allowing a user to prove they own transaction outputs on the blockchain, i.e. their bitcoin. All bitcoin is recorded. How a crypto wallet works Crypto wallets consist of three parts: a public key, a private key, and a public receiving address. Whenever someone. So, what is a hard wallet, and how does it differ from a hot wallet? The main thing to understand is that hard wallets—or hardware wallets—are physical, not. The most popular and easy-to-set-up crypto wallet is a hosted wallet. When you buy crypto using an app like Coinbase, your crypto is automatically held in a. Your wallet stores your private and public keys and interacts with different blockchains to allow you to securely send and receive digital assets. All crypto. A cryptocurrency wallet is a device, physical medium, program or an online service which stores the public and/or private keys for cryptocurrency. A wallet manages cryptocurrencies like Bitcoin, Ethereum, Litecoin, and other altcoins, but does not directly store them.

Maximum Soc Sec Benefit

The maximum SSDI payment is $ per month. The amounts are increased annually. For every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit. So, if you can afford it, waiting could be. Understanding your Social Security benefits is an important part of retirement planning. Use SmartAsset's calculator to determine what your benefits will. And it could get even better for you if you waited to file for Social Security. In , the maximum Social Security benefit for an individual who delayed. retirement benefit? The Social Security Administration (SSA) compares your retirement benefit at your FRA to the maximum spousal benefit off your spouse. Unfortunately, there is still an earnings limit for those who elect to start receiving Social Security benefits before reaching full retirement age. Social. If you haven't reached your full retirement age, $1 in benefits will be deducted for every $2 you earn above the annual limit ($22, in ). In the year you. The maximum benefit at full retirement age (if you hit the cap thirty five years running) is $ It goes up a little every year. Full. The maximum Social Security benefit at the full retirement age is $3, per month in If you wait until age 70 to collect Social Security payments, the. The maximum SSDI payment is $ per month. The amounts are increased annually. For every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit. So, if you can afford it, waiting could be. Understanding your Social Security benefits is an important part of retirement planning. Use SmartAsset's calculator to determine what your benefits will. And it could get even better for you if you waited to file for Social Security. In , the maximum Social Security benefit for an individual who delayed. retirement benefit? The Social Security Administration (SSA) compares your retirement benefit at your FRA to the maximum spousal benefit off your spouse. Unfortunately, there is still an earnings limit for those who elect to start receiving Social Security benefits before reaching full retirement age. Social. If you haven't reached your full retirement age, $1 in benefits will be deducted for every $2 you earn above the annual limit ($22, in ). In the year you. The maximum benefit at full retirement age (if you hit the cap thirty five years running) is $ It goes up a little every year. Full. The maximum Social Security benefit at the full retirement age is $3, per month in If you wait until age 70 to collect Social Security payments, the.

Benefits are based on an employee who began work on January 1 of the year the employee attained age 22 and either retires or dies at age Social Security. Step 1: Explore how the age you start collecting Social Security affects your retirement benefits. Enter your information below to calculate your estimated. In , that max was $3, if you start drawing at your FRA. See the chart below for a rundown of average benefits and maximum benefits depending on your age. Spousal benefits are capped at 50% of the higher-earning spouse's full-retirement-age amount, even if that spouse can collect a higher amount by waiting until. (When the full benefit age reaches 67, benefits claimed at age 70 will be 24 percent higher because of that delay.) The maximum retirement benefit in for. If you wait a year to claim it, you'll forgo the $10, for the first year, but the following year at age 67, you'll receive an annual benefit of $10, or 8%. Specifically, if you are under full retirement age for the entire year, $1 in benefits will be withheld for every $2 you earn over the annual earnings limit ($. In , you earn one credit for each $1, in earnings up to a maximum of four credits per year. Retirement Benefits. Choosing when to retire is one of the. Maximum family benefit While the numbers may look good so far, there's a limit on the total benefit your family can collect. This family maximum benefit is. *The amount of your monthly benefits also increases for each month you wait between age 62 and your FRA, but the rate is lower than 8% per year and varies. You'll need to move carefully to maximize your income stream. Start with our beginner's guide to maximizing your Social Security benefits, then work your way. The calculations use the FICA income limit of $, with an annual maximum Social Security benefit of $45, ($3, per month) for a single person and. To receive the maximum benefit would require earning the maximum FICA salary for nearly your entire career. You would also need to begin receiving benefits at. Maximize My Social Security is one of the two best Social Security tools. It takes into account the widest variety of household configurations. However, you will receive benefits for a longer period. If you collect before your full retirement age, there are income limits if you decide to work. Social. Calculate your future benefits with Social Security's online tools. Find out your full retirement age, and the earning limits if you plan to continue to. Your wages are projected forward based on the wage growth percentage you entered. If you retire before age 67 your full retirement benefit will be reduced by as. In , the income limit is $22, During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits. But if you earn more than $1, in any single month--which is 1/12 of the annual earnings limit of $18, you would not receive a Social Security benefit. What is the maximum Social Security benefit? In , the maximum amount someone can receive in Social Security retirement benefits is $3, per month if they.

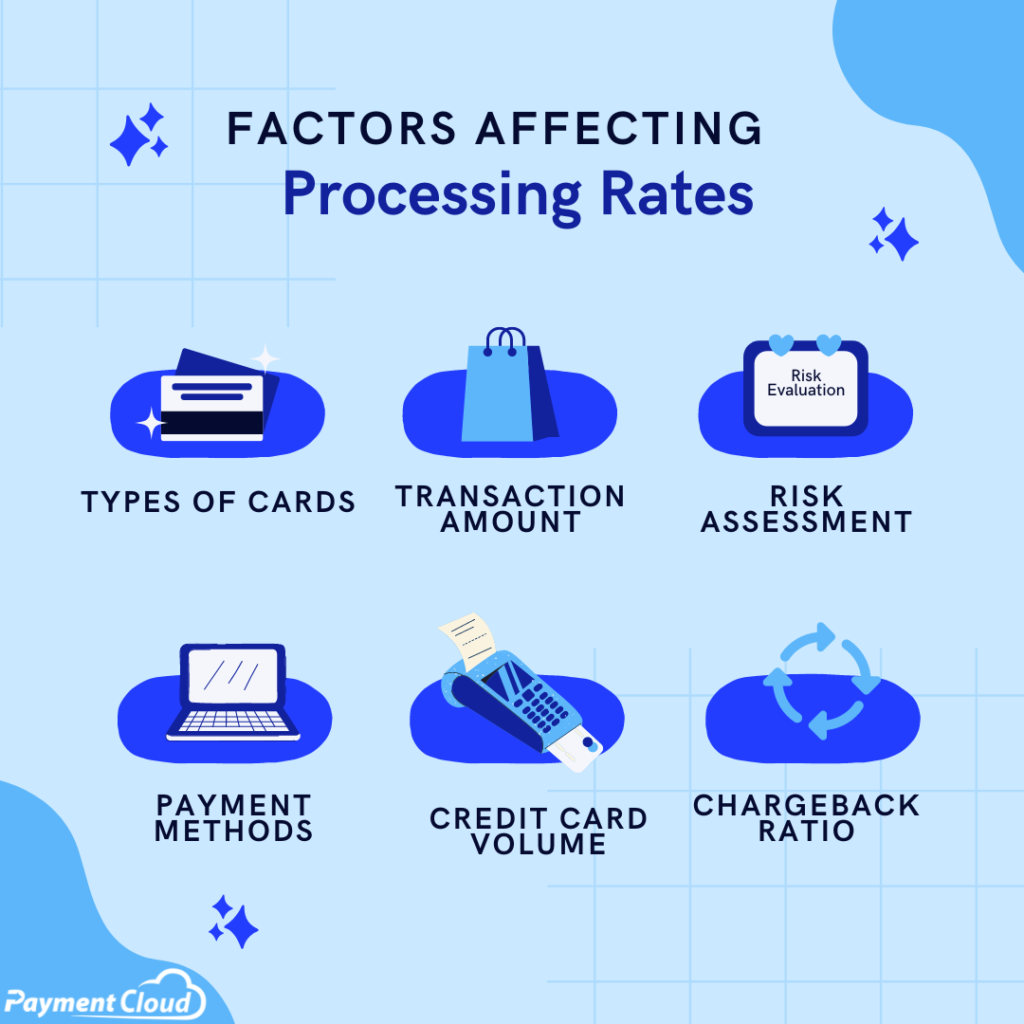

Average Credit Card Processing Rate

Average credit card processing fees range from % for swiped card payments up to % for keyed-in transactions. This is a common question with a common answer: In the U.S., interchange rates average % for credit cards and % for debit cards. But, in truth, the. Credit card fees almost always have a fixed cost and a rate (%). Take square for example, published rate of % + $ See how the math. A flat rate pricing model is when your business is charged a flat rate for every transaction. For example, you could be charged % per credit card you. Image of Toast Flex for Guest Terminal with illustration overlay of hand swiping credit card. Payment Types. One important category that impacts payment. Fair and transparent pricing. No hidden fees. ; % + 10¢. Tap, dip or swipe ; % + 10¢. Manually keyed in transactions or payment links ; % + 25¢. E-. Credit card processing fees can often cost from % to % of a total transaction. Here, learn more about how these charges are calculated. Average credit card processing fees vary. Very roughly, most businesses can expect to pay between % - %. Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction . Average credit card processing fees range from % for swiped card payments up to % for keyed-in transactions. This is a common question with a common answer: In the U.S., interchange rates average % for credit cards and % for debit cards. But, in truth, the. Credit card fees almost always have a fixed cost and a rate (%). Take square for example, published rate of % + $ See how the math. A flat rate pricing model is when your business is charged a flat rate for every transaction. For example, you could be charged % per credit card you. Image of Toast Flex for Guest Terminal with illustration overlay of hand swiping credit card. Payment Types. One important category that impacts payment. Fair and transparent pricing. No hidden fees. ; % + 10¢. Tap, dip or swipe ; % + 10¢. Manually keyed in transactions or payment links ; % + 25¢. E-. Credit card processing fees can often cost from % to % of a total transaction. Here, learn more about how these charges are calculated. Average credit card processing fees vary. Very roughly, most businesses can expect to pay between % - %. Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction .

Visa provides its partners with insight into the Visa Rules. Learn about merchant credit card processing fees, interchange rates, and rules for partners. Per-transaction charges sound deceptively tiny, ranging between 10 and 20 cents each. It's a few cents, right? How bad can that be? Well, these types of fees. Cards. Visa, Mastercard, Discover, American Express. % ; Digital wallets. Apple Pay, PayPal and Venmo. % ; ACH bank payments. Electronic money transfers. Based on the weighted average cost of popular cards and a transaction size of: $ $ How are payment processing fees generally determined by credit card. The average costs for credit card processing ranges from % to % for swiped cards, and % for keyed-in transactions. Average flat-fee credit card processing rates. Flat-rate credit card processor fees typically fall somewhere between % and %, plus 9 to 30 cents per. The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you choose (American. These are what credit card associations charge for using their networks. Assessment fees typically range between % and % depending on the card brand —. You can expect to pay anywhere between 1p and 6p per transaction for authorisation. PCI compliance fee. If your business is taking credit card payments, you're. On average, credit card processing fees can range between % and %. Fees can be charged per transaction, per month or per year depending on the credit card. Average credit card processing fees range from % for swiped card payments up to % for keyed-in transactions. Businesses could start charging you more for using your credit card — make sure the rewards you get are worth it · Processing fees range from % to % but. Learn more about Wells Fargo merchant services credit card processing fees, and better understand what your small business could pay in a typical month. On average, credit card processing fees range from % to % for card-present swiped transactions and around % for online transactions. Please note that. Square Invoice Fees ; Online card transaction, % + 30c, % + 30c ; In-person (tap/dip/swipe), % + 10c, % + 10c ; Manually Entered card payment, % +. A business that pays $ in total credit card processing fees on $10, of credit card sales has an effective rate of 3% or ($ ÷ $10,) × = 3%. It's. See how small changes in your processing fees can make a big difference to your bottom. Try this free credit card processing calculator. Average credit card processing fees in (% to %). How much can you With flat-rate pricing, the payment processor charges a flat fee for each. If you're accepting one of the four major credit card networks, then you're paying somewhere between –% in credit card processing fees.

Can I Add My Paypal Card To Cash App

You can add money to your PayPal Balance Account at select retailers. All you need to do is swipe your PayPal-branded Debit Card or generate a barcode in your. Why can't I link my credit or debit card to my PayPal account? · Different billing address · Authorization charge declined · Limit of cards in account reached. The card works like any debit card you would get from a bank, so you can use your Cash App balance on PayPal. Because it's a debit card, you'll need to add the. Download the Cash App · In your Cash App, create an account with your phone number or email address · Enter your MAJORITY debit card details, along with your name. You'll need to add money to the Send Account from your American Express Card before you can send money. When you add money to your Send Account, it will appear. Please help I really want to buy stuff with my cash app card - You can add or transfer funds like with a real credit card. But if it does NOT. Enter your Cash App Cash Card information. Click Link card. Transfer money from your PayPal account to your Cash App Cash Card. Open the PayPal. Tap Accounts. · Scroll down to 'Linked bank and cards'. · Tap Add new. · Link your card manually or connect your PayPal account to your bank. However, you can transfer money to your linked bank account, then to the Cash app. Or, you can get the Cash App Cash Card and link it to PayPal. You can add money to your PayPal Balance Account at select retailers. All you need to do is swipe your PayPal-branded Debit Card or generate a barcode in your. Why can't I link my credit or debit card to my PayPal account? · Different billing address · Authorization charge declined · Limit of cards in account reached. The card works like any debit card you would get from a bank, so you can use your Cash App balance on PayPal. Because it's a debit card, you'll need to add the. Download the Cash App · In your Cash App, create an account with your phone number or email address · Enter your MAJORITY debit card details, along with your name. You'll need to add money to the Send Account from your American Express Card before you can send money. When you add money to your Send Account, it will appear. Please help I really want to buy stuff with my cash app card - You can add or transfer funds like with a real credit card. But if it does NOT. Enter your Cash App Cash Card information. Click Link card. Transfer money from your PayPal account to your Cash App Cash Card. Open the PayPal. Tap Accounts. · Scroll down to 'Linked bank and cards'. · Tap Add new. · Link your card manually or connect your PayPal account to your bank. However, you can transfer money to your linked bank account, then to the Cash app. Or, you can get the Cash App Cash Card and link it to PayPal.

All you have to do is link your card to your PayPal account and transfer funds from your PayPal account to your Cash app. Step 1: Link Your Gift Card To Your. PayPal is a simple and secure way to get paid back, send money to friends, find cash back offers from brands you love, manage your account and more. Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is for; Tap Pay. Mobile device: Add cards to PayPal with the Wells Fargo Mobile appCollapse · 1. In the Wells Fargo Mobile app, tap Menu in the bottom bar, select Card Settings. You can request a card from cash app, then link it to paypal, they might even give you a virtual card while you wait so you can do it instantly. How do you add money to your Card? Use the no-cost1 Direct Deposit service and you could have access to your funds up to 2 days faster2 than what traditional. How do I add cash to PayPal? To add cash to PayPal, go to your Wallet in the PayPal app while you're at the store. Then, select Add Cash. Select the store you. You don't need to link your bank account to set up a PayPal account, but you will need to link it to your bank account or an eligible debit card before you can. You can now access your PayPal account when using Samsung Pay! And that means, you can make in-store purchases with your PayPal balance or cards. Bank or Debit Card Transfer · Go to Wallet. · Click Transfer Money. · Click Transfer to your bank. · Select in minutes. · Follow the instructions. You can add cash at any participating retailer (including Walmart, CVS, 7-Eleven, Walgreens, Rite Aid, Dollar General, Dollar Tree, Family Dollar, and many. Yes. Once you've confirmed your email address, you can transfer money to any eligible Visa or Mastercard debit card. You can add your credit card, debit card, bank account, PayPal account, or mobile phone as a new payment method for your Microsoft account. Why can't I link my credit or debit card to my PayPal account? · Different billing address · Authorization charge declined · Limit of cards in account reached. Unfortunately, as of now, there is no direct way to transfer money from Cash App to PayPal. Cash App and PayPal are two separate platforms with. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. If they will defend my rights as a consumer as well as credit card companies do, then I no longer have a problem using the app. This is not so much a case. You can also opt for a PayPal debit card that links directly to your account. Doesn't PayPal Have Instant Transfer? Yes, PayPal does have an option for instant. If they will defend my rights as a consumer as well as credit card companies do, then I no longer have a problem using the app. This is not so much a case.

Options On Forex

FX options are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined exchange rate. An FX option is a contract that confers on the holder the right but not the obligation to exchange an amount of one currency for another at a pre-agreed. Futures and options trading allows you to benefit from capital efficiency, extended trading hours, multiple asset classes, and market volatility. When choosing between forex trading and binary options trading, consider factors such as flexibility, complexity, risk tolerance, and control over trades. Forex. Devexperts develops FX Options trading platforms for market makers, liquidity providers, institutional brokers and dealers, wealth management firms. We not only offer a wide range of FX options designed to de-risk your business from foreign exchange volatility, but we'll also guide you through the pros and. A currency option (also known as a forex option) is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency. An FX option can either be bought or sold. Options prices are derived from the base currency, which is the first currency in the currency pair (eg euros in EUR/. FX Options Quotes - detailed information on forex options, including call and put strike prices, last price, change, volume, and more. FX options are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined exchange rate. An FX option is a contract that confers on the holder the right but not the obligation to exchange an amount of one currency for another at a pre-agreed. Futures and options trading allows you to benefit from capital efficiency, extended trading hours, multiple asset classes, and market volatility. When choosing between forex trading and binary options trading, consider factors such as flexibility, complexity, risk tolerance, and control over trades. Forex. Devexperts develops FX Options trading platforms for market makers, liquidity providers, institutional brokers and dealers, wealth management firms. We not only offer a wide range of FX options designed to de-risk your business from foreign exchange volatility, but we'll also guide you through the pros and. A currency option (also known as a forex option) is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency. An FX option can either be bought or sold. Options prices are derived from the base currency, which is the first currency in the currency pair (eg euros in EUR/. FX Options Quotes - detailed information on forex options, including call and put strike prices, last price, change, volume, and more.

How does options trading work? Options trading works using contracts which give the holder the right to trade an underlying market at a set price – called the. On this page we look at the differences between trading forex and options, and why we believe trading options is better. Manage risk and find opportunities everywhere from G10 to emerging markets futures and options from the most liquid, capital-efficient FX futures market. I have just joined IBKR and still exploring. My question is about FX options. Do you know if IBKR provides it? If yes, how/where? Learn about the liquidity, versatility, and efficiencies FX options on futures can bring to your G10 and emerging markets currency strategies. An advantage you have with the Forex Currency Trading System (Forex) as compared to Options trading is your ability to trade 24 hours a day, five days a week. An FX option - which can be a call or a put, is used to set an exchange rate for a future transaction in order to protect against unfavourable currency. AvaOptions is a unique trading platform which lets you trade FX options like a pro ➤ Open fx options trading account & trade forex options! Unlock Forex options for effective risk management and strategic trading. Dive into the dynamic world of currency derivatives. A currency option is a type of foreign exchange derivative contract that confers to its holder the right, but not the obligation, to engage in a forex. An FX option is an insurance policy on an exchange rate. Its pricing is determined by factors including time to expiry, strike rate, and volatility of the. Trade Forex Options Online with Saxo. Access 45+ FX vanilla options with maturities from one day to 12 months that allows you to trade across devices. Learn to trade forex binary options. You will pick up all the basics, plus you'll get familiar with specific strategies to help you progress as a binary option. FX option expiries for 10 September 10am New York cut · FX option expiries for 10 September 10am New York cut · China to issue up to €2 bln in euro sovereign. Forex is easier to trade vs options because traders simply have to buy or sell and then manage Forex trades. That can be done with limited orders and is easy to. FX options function similarly to other options contracts. A trader pays a premium to purchase the option, which grants them the right to buy (call option) or. Australian dollar currency options are quoted in terms of US dollars per unit of the underlying currency and premium is paid and received in US dollars. In our Forex vs options guide, you'll gain a better understanding of which instrument you should trade and why you should trade with us at CAPEX. A foreign exchange option (commonly shortened to just FX option or currency option) is a derivative financial instrument that gives the right but not the. The 8 Best Forex Options Brokers rated and reviewed. An overview of the brokers that made this list with their pros & cons for traders.