adidasultraboostsneakers.site

Market

How To Fix A Cracked Computer Screen Without Replacing It

I am having the same problem. Screen cracked without any obvious reason. I sent it to be repaired paid $ dollars and it cracked again after 7 days. Do you have a broken screen or other physical damage? Make an in-store reservation and a Geek Squad Agent will give you an initial estimate of repair costs. If. To fix a cracked computer screen without replacing it, you can try temporary solutions like using clear nail polish, a screen protector, or petroleum jelly. It is recommended that you try to troubleshoot the system before replacing the laptop screen. computer technicians. We have professional and. Replace only the screen. You don't need to replace the whole computer. There's no way to “fix” a cracked screen without completely replacing it. without having Accidental Damage coverage, you have to cover the cost of repair yourself. For help with getting your device repaired, Contact Dell Technical. Hook it up to a monitor or a TV. As far as fixing it, its different for every model but it's normally a complete teardown to get to the screen. M posts. Discover videos related to How to Fix Broken Laptop Screen without Replacing It on TikTok. See more videos about How to Fix A Laptop Black. Fixing a cracked tablet screen without replacing it involves several creative and accessible methods. For minor cracks, applying a screen protector or using. I am having the same problem. Screen cracked without any obvious reason. I sent it to be repaired paid $ dollars and it cracked again after 7 days. Do you have a broken screen or other physical damage? Make an in-store reservation and a Geek Squad Agent will give you an initial estimate of repair costs. If. To fix a cracked computer screen without replacing it, you can try temporary solutions like using clear nail polish, a screen protector, or petroleum jelly. It is recommended that you try to troubleshoot the system before replacing the laptop screen. computer technicians. We have professional and. Replace only the screen. You don't need to replace the whole computer. There's no way to “fix” a cracked screen without completely replacing it. without having Accidental Damage coverage, you have to cover the cost of repair yourself. For help with getting your device repaired, Contact Dell Technical. Hook it up to a monitor or a TV. As far as fixing it, its different for every model but it's normally a complete teardown to get to the screen. M posts. Discover videos related to How to Fix Broken Laptop Screen without Replacing It on TikTok. See more videos about How to Fix A Laptop Black. Fixing a cracked tablet screen without replacing it involves several creative and accessible methods. For minor cracks, applying a screen protector or using.

The only cost-effective fix for a cracked laptop screen is an outright replacement of the screen. In most screens, the glass is permanently bonded. 4) If only the screen needs replacement, we can now isolate it without having to also replace other connected parts such as the bezel or frame. 5) Promotional. This article will discuss 5 tips to fix cracked screen replacement on your Take a local backup on your PC. Ask a professional repair company like. 8 Tips To Fix Cracked Laptop Screen Without Replacing · 1. Inspect for Dust or Debris · 2. Try an External Monitor · 3. Fix the Dead Pixels · 4. Update the Video. For stuck pixels, use either pressure and heat or screen-fixing software to repair the screen. If there's a scratch on your screen, buy a scratch repair kit to. To fix a cracked computer screen without replacing it, you can try temporary solutions like using clear nail polish, a screen protector, or petroleum jelly. The computer is most vulnerable to screen damage when it falls in the open position – the display isn't protected in any way then. However, the screen can also. A few pieces of tape to secure the new LCD to the laptop frame. You can also check online for a screen repair kit for your specific laptop. If you don't have. repair without a plan— it's simple at any uBreakiFix® store. Get started. iPhone. Samsung Galaxy. Google Pixel. Computer. M posts. Discover videos related to How to Fix Broken Laptop Screen without Replacing It on TikTok. See more videos about How to Fix A Laptop Black. First, you could contact the manufacturer and find out how much the repair or replacement will cost. In most cases, this can be very expensive – it might even. First, you could contact the manufacturer and find out how much the repair or replacement will cost. In most cases, this can be very expensive – it might even. A technician may be able to fix the problem without replacing the entire screen. broken computer screen and recommend repair or replacement. EezIT's computer. This 3-minute article discusses the pros and cons of cracked laptop screen repair. Learn your options and then contact GEEKAID Computer and Network Support. This 3-minute article discusses the pros and cons of cracked laptop screen repair. Learn your options and then contact GEEKAID Computer and Network Support. If you have a cracked or damaged laptop/computer screen, then the best course of action is usually to take it for repairs at an authorized service center. In. The best way to repair your cracked screen without risking further damage to the phone is to bring it to a professional repair service. Convert a Laptop With a Broken Screen Into a Quiet, Space Saving Desktop · 1. Hook up the external monitor and boot up the laptop. · 2. Hit F8 to switch monitors. Instead, go to ebay and try to find the replacement LCD, the entire cover for your computer, or even better, your computer with a blown motherboard but intact. I am having the same problem. Screen cracked without any obvious reason. I sent it to be repaired paid $ dollars and it cracked again after 7 days.

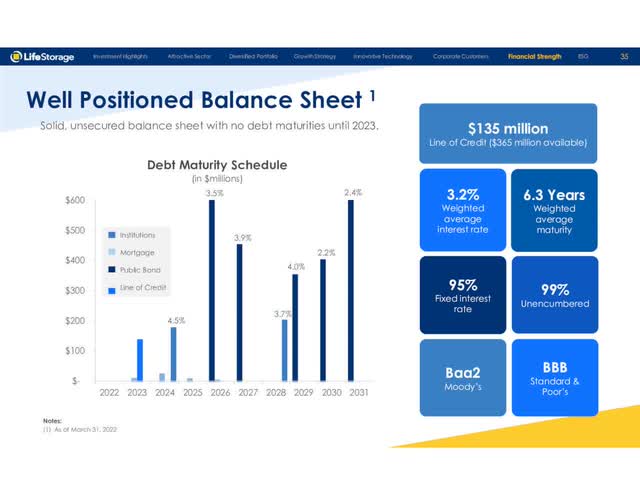

Life Storage Lsi

Life Storage, Inc. operates as a self-administered and self managed real estate investment trust. The Company acquires and manages self storage properties. Life Storage, Inc. is a self-administered and self-managed equity REIT that is in the business of acquiring and managing self-storage facilities. Life Storage Inc. (LSI) Share Price NYSE $ As on Jul EDT up-down-arrow $ • %. Looking to buy Life Storage Stock? View today's LSI stock price, trade commission-free, and discuss LSI stock updates with the investor community. Life Storage Inc (NYSE:LSI) Intrinsic Valuation. Check if LSI is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. Historical daily share price chart and data for Life Storage, Inc. from to adjusted for splits and dividends. LSI was delisted after July Life Storage LLC, formerly Life Storage, Inc., is a self-administered and self-managed equity real estate investment trust (REIT). Dividend history for stock LSI (Life Storage, Inc.) including historic stock price, dividend growth rate predictions based on history, payout ratio history and. Life Storage, Inc. is a real estate investment trust, which engages in the acquisition, ownership, and management of self-storage properties. It offers. Life Storage, Inc. operates as a self-administered and self managed real estate investment trust. The Company acquires and manages self storage properties. Life Storage, Inc. is a self-administered and self-managed equity REIT that is in the business of acquiring and managing self-storage facilities. Life Storage Inc. (LSI) Share Price NYSE $ As on Jul EDT up-down-arrow $ • %. Looking to buy Life Storage Stock? View today's LSI stock price, trade commission-free, and discuss LSI stock updates with the investor community. Life Storage Inc (NYSE:LSI) Intrinsic Valuation. Check if LSI is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. Historical daily share price chart and data for Life Storage, Inc. from to adjusted for splits and dividends. LSI was delisted after July Life Storage LLC, formerly Life Storage, Inc., is a self-administered and self-managed equity real estate investment trust (REIT). Dividend history for stock LSI (Life Storage, Inc.) including historic stock price, dividend growth rate predictions based on history, payout ratio history and. Life Storage, Inc. is a real estate investment trust, which engages in the acquisition, ownership, and management of self-storage properties. It offers.

Life Storage, Inc. market cap history and chart from to LSI was delisted after March 31, and its final market cap on that date was $B. Financial Summary of Life Storage, Inc.(LSI), Life Storage, Inc. is a self-administered and self-managed equity REIT that is in the business of ac. Life Storage Inc Stock forecast & analyst price target predictions based on 2 analysts offering months price targets for LSI in the last 3 months. Get the current share price of Life Storage (LSI) stock. Current & historical charts, research LSI's performance, total return and many other metrics free. Life Storage is proactively adopting sustainable business practices, delivering value to our stakeholders and doing good for our world. Financial Summary of Life Storage, Inc.(LSI), Life Storage, Inc. is a self-administered and self-managed equity REIT that is in the business of ac. Life Storage, Inc. is a fully integrated, self-administered and self-managed real estate investment trust (REIT) that acquires and manages self-storage. Company profile for Life Storage (LSI) including business summary, key statistics, ratios, sector. Current and historical revenue charts for Life Storage. As of September Life Storage's TTM revenue is of $ B. Life Storage, Inc. was a real estate investment trust headquartered in Williamsville, New York, that invested in self-storage units. Note: Life Storage, Inc. (LSI) has been acquired. You can access all historical research reports on Life Storage, Inc. (LSI) below. Extra Space Storage ($EXR) leadership, quarterly reports, stock price, SEC filings, press releases, presentations, and more. Ticker LSI. Exchange NYSE More · Industry REIT - Industrial More · Sector Financial More. LSI - Life Storage Inc - Registered Shares Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). Life Storage Inc - Registered Shares (LSI) has 8 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange. Extra Space Storage Inc. (NYSE:EXR) entered into a definitive merger agreement to acquire Life Storage, Inc. (NYSE:LSI) from State Street Corporation (NYSE:STT. Life Storage · Forbes Lists · More on Forbes · Pink's Hit Song's Sales Soar Nearly 1,% Following The DNC · Alabama Reaches A New Peak On One Chart With Their. Life Storage · Forbes Lists · More on Forbes · Pink's Hit Song's Sales Soar Nearly 1,% Following The DNC · Alabama Reaches A New Peak On One Chart With Their. Track Life Storage Inc - Registered Shares (LSI) Stock Price, Quote, latest community messages, chart, news and other stock related information.

Registering As A Sole Trader Uk

Simple, you just need to register. First, check if sole trader is the right structure for your company. Then, choose a name for your business, check what. 1. Get your idea nailed · 2. Think of a name · 3. Make a plan · 4. Register with HMRC · 5. Start trading! To register you simply need to tell HMRC that it can expect a Self Assessment tax return from you. You can either do this by registering online or by printing. Once your NI is sorted, you need to register with HMRC and start a self-assessment tax return. After registering, you will receive a digit Government Gateway. When registering as a sole trader in the UK, you must pick a trading name. This is the name you will use for your business and will be displayed on any. When you start your own business, you'll need to decide which company format to register with HMRC. The structure you register your company under will. To register as a sole trader yourself (directly with HMRC) you must have a government gateway account. It typically takes around 10 days to get an activation. To register your Sole Trader business you will need to provide the following details: Your full name; Your current address; Your National Insurance Number; Your. How to register as a sole trader · Complete the online application via HMRC. · Print the application and send it to the postal address shown. · Call HMRC Simple, you just need to register. First, check if sole trader is the right structure for your company. Then, choose a name for your business, check what. 1. Get your idea nailed · 2. Think of a name · 3. Make a plan · 4. Register with HMRC · 5. Start trading! To register you simply need to tell HMRC that it can expect a Self Assessment tax return from you. You can either do this by registering online or by printing. Once your NI is sorted, you need to register with HMRC and start a self-assessment tax return. After registering, you will receive a digit Government Gateway. When registering as a sole trader in the UK, you must pick a trading name. This is the name you will use for your business and will be displayed on any. When you start your own business, you'll need to decide which company format to register with HMRC. The structure you register your company under will. To register as a sole trader yourself (directly with HMRC) you must have a government gateway account. It typically takes around 10 days to get an activation. To register your Sole Trader business you will need to provide the following details: Your full name; Your current address; Your National Insurance Number; Your. How to register as a sole trader · Complete the online application via HMRC. · Print the application and send it to the postal address shown. · Call HMRC

HMRC recommend registering as soon as you start trading, but no later than 5 October of your second tax year. The standard tax year runs from 6 April to 5 April. But it often simplifies things to register as self-employed sooner, in case anyone needs to see evidence of it - like opening business accounts. As a sole trader, you'll need to pay income tax based on your business profits, along with National Insurance contributions (NICs). To register you simply need. Register as a sole trader with HMRC: Complete the necessary registration forms with HMRC to inform them of your self-employment status and tax obligations. When registering as a sole trader, you typically have to provide your name, address, date of birth, phone number, NI number, business name, business type and. To register as a sole trader, you must register with HMRC for self assessment. Ideally, you should register as soon as possible after starting your business but. You'll need to register as self employed (a sole trader) by 5 October in your business's second tax year. You could be fined if you do not. The tax year runs. Deadline warning: You must register for self-assessment by 5 October in the second tax year of your business's life. A UK tax year runs 1 year from 6 April to 5. Setting up as a sole trader is straightforward. You need to register with HMRC within three months of becoming self-employed – even if it's on a part-time basis. This sole trader registration form needs to be filled out and completed online, then submitted to HMRC before January 31st each year. To do this, you must fill. You would register as Self-Employed, the UTR will stay the same. If you have been unable to register contact us online using 'Ask HMRC Online' and ask to speak. There's no set cost to register as a sole trader in the UK — you can do it free through HMRC. However, the process can be time-consuming, and you'll need to. The paradox of registering as a sole trader in the UK is that there isn't a public register of sole traders. As a private person you can sell goods or. Starting Up As a Sole Trader business? adidasultraboostsneakers.site offers a managed FREE ONLINE Sole Trader Registration package. To register as a sole proprietor in the UK, you need to have all your documents related to your National Insurance and income tax ready. According to sole. When registering as a sole trader in the UK, you must pick a trading name. This is the name you will use for your business and will be displayed on any. Registering as a sole trader costs nothing, while accounting costs and tax liabilities are likely to be cheaper than if you started a limited company. 6. Sole. As a sole trader, you will also be required to register for VAT if you expect to make sales of £85, or more in a month period. In this case, you will need. Registering a sole trader business in the UK · Speak with HMRC. · Fill out the HMRC self-assessment registration form online or by mail. · Get your HMRC online. You can trade under your own name, or you can choose another name for your business. You don't need to register your name.

How To Log Mileage For Taxes

Most people don't actually need to track miles for taxes in order to claim this write-off. That's because there are two ways to calculate your tax deduction. Use this tax deduction tracker and mileage log to make sure you're tax-compliant with the IRS. How Do Rideshare (Uber and Lyft) Drivers Pay Taxes. Standard mileage. Multiply your business miles driven by the standard rate. For , the rate is $ per mile. · Actual car expenses. Track all of your. The taxpayer uses his or her vehicle for ministry adidasultraboostsneakers.sites of the family use the vehicle for personal adidasultraboostsneakers.site taxpayer keeps a mileage log for the first. You can deduct a flat rate per mile driven for business using the standard mileage rate method. The actual expenses method requires you to track and deduct the. Stride is a completely free expense and mileage tracker for businesses that helps you automatically track your business miles and expenses and save. Just make sure you keep a good record of your schedule. Make sure every appointment has a location. If you are audited, you can use your. A mileage log is a record of your vehicle miles traveled for business over a particular period kept in a spreadsheet, form, logbook or online application that. For maximum accuracy, odometer readings should be taken at the beginning and end of your trips. Related: 6 Common IRS Tax Penalties For Small Businesses. Many. Most people don't actually need to track miles for taxes in order to claim this write-off. That's because there are two ways to calculate your tax deduction. Use this tax deduction tracker and mileage log to make sure you're tax-compliant with the IRS. How Do Rideshare (Uber and Lyft) Drivers Pay Taxes. Standard mileage. Multiply your business miles driven by the standard rate. For , the rate is $ per mile. · Actual car expenses. Track all of your. The taxpayer uses his or her vehicle for ministry adidasultraboostsneakers.sites of the family use the vehicle for personal adidasultraboostsneakers.site taxpayer keeps a mileage log for the first. You can deduct a flat rate per mile driven for business using the standard mileage rate method. The actual expenses method requires you to track and deduct the. Stride is a completely free expense and mileage tracker for businesses that helps you automatically track your business miles and expenses and save. Just make sure you keep a good record of your schedule. Make sure every appointment has a location. If you are audited, you can use your. A mileage log is a record of your vehicle miles traveled for business over a particular period kept in a spreadsheet, form, logbook or online application that. For maximum accuracy, odometer readings should be taken at the beginning and end of your trips. Related: 6 Common IRS Tax Penalties For Small Businesses. Many.

The business mileage deduction can be a huge boost at tax time, but the mileage log that you keep must be accurate and follow certain requirements to satisfy. The IRS requires taxpayers to disclose the total number of miles driven by their car during the tax year. The total mileage number must be indicated on Form. Everlance is one of the most popular mileage tracker apps among rideshare drivers. The app uses GPS satellites to capture your location accurately. GPS tracking. A mileage log for taxes is used to track business mileage for tax deductions. Business owners and self-employed individuals can use a mileage log to document. Sole proprietors are able to change their deduction method by tapping Mileage tracking in the settings menu, or from their tax profile. If you're not a sole. Tracking Mileage And Gas Receipts For Taxes Manually · 1) Create A Logbook For Each Vehicle · 2) Record Mileage For Every Trip · 3) Include Other Information · 4). What's more, lying on your tax returns will get you fined. Instead of saving money, you'll end up losing money. How to build your mileage log for tax deductions. How to Claim Mileage on Taxes Self-employed workers can claim their mileage deduction on their Schedule C form, rather than the Schedule A form for itemized. 2 Pcs Auto Mileage & Expense Log Book for Car Taxes Vehicle Maintenance Expense Track Record Notebook Small Business Gas Miles Log Book for Driver 5 x Inch. Mistake #1: Having Untimely Mileage Logging. Mileage logs are meant to be an accurate story of your employees' driving activities for work. BE WISE, CHOOSE MILEAGEWISE · Mileage Tracker App · Web Dashboard · Mileage Log For IRS audit · Google Timeline · Tax Prep & Defense Services · Automatic. When an employee drives their own car for work, they can keep track of the miles traveled and submit their mileage reimbursement information to their employer. To help you stay on top of it all and run your business smoothly, we're here to guide you through the best mileage-tracking methods. To claim any auto mileage tax deductions, your business needs to maintain meticulous records of the mileage driven, including personal miles. While many. If you're not accurately tracking your mileage and expenses, you can still be hit with an audit. In addition, you will not guarantee the maximum deductible for. Mileage Ace is the easiest way how to track mileage for taxes. If a basic IRS mileage log is all you need, Mileage Ace gives you that with the click of a. According to the reports of IRS**, Standard mileage rate for is cents which means for every miles, you can deduct $ from your tax, i.e. Simply multiply the business miles by the mileage rate. * = $56 tax deduction in What Qualifies as a Tax-Deductible Business Trip? If you. Every day, Hurdlr tracks over 1M miles for tax deductions and expense reimbursements, automatically.

What Is The Lowest Fha Interest Rate

FHA Mortgage Rates · year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. · year. FHA Loan benefits are just the beginning · % down payment option · More flexible credit guidelines · Rates as low as % (% APR). What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. AHFC interest rates are posted daily Monday to Friday, excluding state holidays. Rates are valid each business day up to until 10pm. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment. FHA Loans allow lower credit scores, smaller down payments (as low as percent), cheaper closing costs, and more. Lower interest rates. Because FHA Loans are. Compare FHA mortgage rates today from major lenders. NerdWallet's FHA loan interest rate is based on a daily survey of national lenders. MIPs range from % to % of the loan balance on a year FHA loan and % to % of the loan balance on a year FHA loan. Today's FHA Loan Rates ; % · Year Fixed · % · %. FHA Mortgage Rates · year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. · year. FHA Loan benefits are just the beginning · % down payment option · More flexible credit guidelines · Rates as low as % (% APR). What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. AHFC interest rates are posted daily Monday to Friday, excluding state holidays. Rates are valid each business day up to until 10pm. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment. FHA Loans allow lower credit scores, smaller down payments (as low as percent), cheaper closing costs, and more. Lower interest rates. Because FHA Loans are. Compare FHA mortgage rates today from major lenders. NerdWallet's FHA loan interest rate is based on a daily survey of national lenders. MIPs range from % to % of the loan balance on a year FHA loan and % to % of the loan balance on a year FHA loan. Today's FHA Loan Rates ; % · Year Fixed · % · %.

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Compare and shop for current FHA mortgage rates from lenders in your area. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. See how FHA mortgage rates compare ; year fixed FHA, %, % ; Conventional year fixed ; Conventional year fixed, %, %. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, First Home, First Generation & Salute ME Loan Rates ; First Home Loan 0 pts with Advantage. % · % ; First Home Loan 0 pts (no Advantage). % · %. How does an FHA Loan compare to other Elements mortgage options? ; Interest Rate As Low As. Purchase: % for Year Fixed. Refinance: % for Year. FHA loan borrowers are insured up to % financing on a home's value, with as low as % down. This is granted provided borrowers meet particular mortgage. lowest level since February Rates continue to soften due to incoming economic data that is more sedate. But despite the improving mortgage rate. Today's FHA Loan Rates ; % · Year Fixed · % · %. For most of early , FHA mortgage rates have been near 7 percent. The table below brings together a comprehensive national survey of mortgage lenders to help. No, buying a home via an FHA mortgage at a 7% interest rate is not necessarily dumb; it depends on individual financial circumstances and goals. Current APR on year FHA loans is %, making it a good option for those looking to refinance to a shorter repayment period. Bank of America — Best for. Learn how to get the best FHA Loan and Mortgage Rates with , , , , , , , & Credit Score and tips on how to improve your credit. An “N/A” interest rate is a result of market volatility and changing interest rates. CalPLUS FHA with 2% Zero Interest Program. High Balance Loan Limit Fee: N. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps. SONYMA's Low Interest Rate Programs (Year Mortgage) ; Achieving the Dream Mortgage Program ; Current Interest Rate (short-term lock-in rate), %, %. Optimal Blue, Year Fixed Rate FHA Mortgage Index [OBMMIFHA30YF] Mortgage Rates Interest Rates Money, Banking, & Finance. Releases. More Series. How to Get a Lower Interest Rate on Your FHA Mortgage: Credit Scores If you If you start working on your credit by paying on time every time for at least.

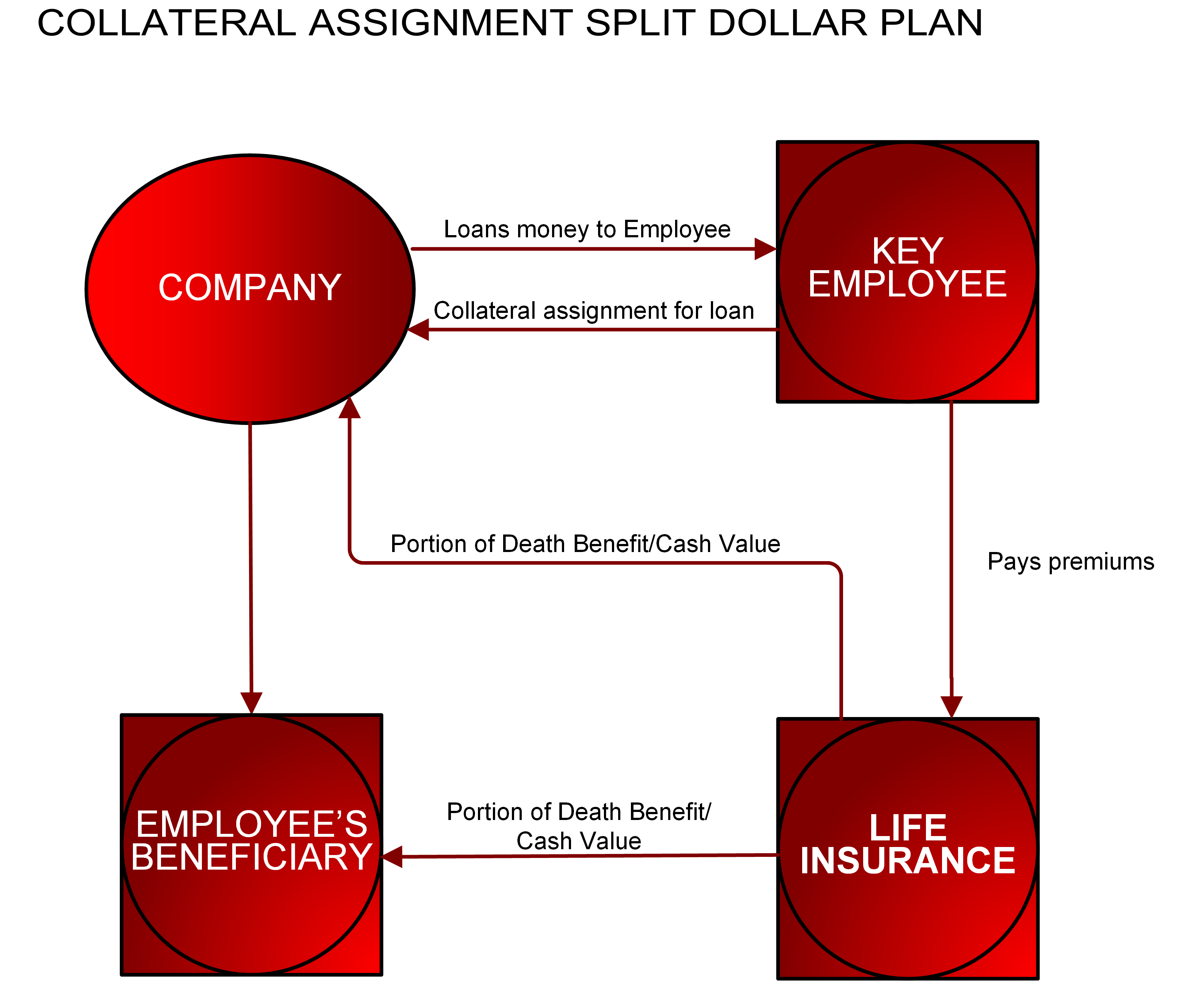

Split Dollar Plan

A private split dollar arrangement is typically an agreement between an individual and an irrevocable life insurance trust, designed to provide estate tax. What is a Split Dollar Program? A split dollar arrangement is a plan in which a life insurance policy's premium, cash values, and death benefit are split. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life. The regulations provide tax rules that reflect the underlying economics of split-dollar life insurance arrangements,stated Treasury Assistant Secretary for Tax. In an economic benefit regime, or economic benefit arrangement, the employer owns the policy. They pay policy premiums and decide on the employee's rights and. Split dollar life insurance is a written arrangement typically between an employer and an employee to share the costs and benefits of a. Learn the benefits of rewarding your employees with life insurance using a split dollar plan. The employer and the executive could enter into a Split Dollar arrangement where the employer pays for and owns a level death benefit on the life of the. There are two main methods that can be used to create split dollar policies: · This allows employers to easily pay for employee benefits packages in bulk, which. A private split dollar arrangement is typically an agreement between an individual and an irrevocable life insurance trust, designed to provide estate tax. What is a Split Dollar Program? A split dollar arrangement is a plan in which a life insurance policy's premium, cash values, and death benefit are split. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life. The regulations provide tax rules that reflect the underlying economics of split-dollar life insurance arrangements,stated Treasury Assistant Secretary for Tax. In an economic benefit regime, or economic benefit arrangement, the employer owns the policy. They pay policy premiums and decide on the employee's rights and. Split dollar life insurance is a written arrangement typically between an employer and an employee to share the costs and benefits of a. Learn the benefits of rewarding your employees with life insurance using a split dollar plan. The employer and the executive could enter into a Split Dollar arrangement where the employer pays for and owns a level death benefit on the life of the. There are two main methods that can be used to create split dollar policies: · This allows employers to easily pay for employee benefits packages in bulk, which.

A split-dollar plan is an arrangement between two parties that involves “splitting” the premium payments, cash values, ownership of the policy, and death. In a traditional split dollar plan, the part of the policy premium paid by the employer is equal to the increase in policy cash value each year. At some point. Split dollar refers to an arrangement in which a life insurance policy's premiums, cash values and death benefit are split between the insured employee and the. As stated above, in a split dollar life insurance plan the costs and the benefits of the permanent life insurance policy are allocated among the parties to the. In a split dollar arrangement the employer is offering a loan to the employee which is utilized to pay the premium of a life insurance policy. In an endorsement arrangement, the employer. (bank) owns the insurance policy and controls all rights of ownership; in a collateral assignment arrangement, the. Split-dollar life insurance is an arrangement that allows you to offer valuable life insurance benefits to your executives and share the cost. One of the most popular techniques for using business dollars to pay life insurance premiums is through split dollar arrangements. “Split dollar” is a term. WHAT IS AN “EXIT,” “TERMINATION” OR “ROLLOUT”? An exit, termination, or rollout (collectively, an “exit”) of any split-dollar arrangement generally refers. A split-dollar arrangement is a strategy in which a life insurance policy's premium, cash values and/or death benefits are split between two parties (policy. What is a Split Dollar Program? A split dollar arrangement is a plan in which a life insurance policy's premium, cash values, and death benefit are split. Advantages of split dollar life insurance plans · A split dollar plan allows an executive to obtain life insurance coverage using employer funds. · The. A split-dollar “policy” is not an insurance policy but refers to a contract between the parties that sets out their duties to split the costs and their rights. With an economic benefit Split Dollar arrangement, the employer applies for and owns the life insurance policy on the life of an executive. The policy is issued. Principal® Loan Split Dollar is a plan that allows employers to reward key employees by helping them meet their financial security goals, while also providing. The proposed regulations provide that, in the case of an equity split-dollar life insurance arrangement, the value of the economic benefits provided to the. This arrangement is not a type of insurance policy, or insurance contract. It is simply a way for parties to share the attributes of a life insurance policy by. Any arrangement between an owner and a non-owner of a life insurance contract is treated as a split-dollar life insurance arrangement (regardless of whether the. Split-dollar strategies split the costs and benefits of a life insurance policy between the employer and employee. Split-dollar arrangements can be effective. A (b)split-dollar life insurance arrangement is an arrangement where the premiums, cash-surrender value, or death benefits are split between an owner.

The Best Pest Control Company

The results below include top rodent and insect control companies; from a termite inspection to yearly pest maintenance, you'll likely find the right pest. We are a neighborhood, family-run pest control and exterminating business situated in Bedford, Massachusetts. We offer dependable, high-quality services. Pestpac charges companies per customer, the more customers the more they charge. Upvote. Best Home & Property Services offers complete pest control, landscaping, crawl space encapsulation, basement waterproofing & more in The Grand Strand. As a locally owned pest control company, LaJaunie's pest control has been providing the best pest control in Belle Chasse and the rest of Plaquemines Parish. How to Choose a Pest Control Company. There are many things to consider when selecting a pest control firm to ensure you get the best possible results. Below. Free price estimates from local Pest Control Companies. Tell us about your project and get help from sponsored businesses. Yelp. Look for Quality and Value when choosing a pest control company, just like you do for any other purchase in your daily life. Costs and expertise are essential. The Today's Homeowner team has researched some of the top pest control companies in Warren to help you make the right decision. The results below include top rodent and insect control companies; from a termite inspection to yearly pest maintenance, you'll likely find the right pest. We are a neighborhood, family-run pest control and exterminating business situated in Bedford, Massachusetts. We offer dependable, high-quality services. Pestpac charges companies per customer, the more customers the more they charge. Upvote. Best Home & Property Services offers complete pest control, landscaping, crawl space encapsulation, basement waterproofing & more in The Grand Strand. As a locally owned pest control company, LaJaunie's pest control has been providing the best pest control in Belle Chasse and the rest of Plaquemines Parish. How to Choose a Pest Control Company. There are many things to consider when selecting a pest control firm to ensure you get the best possible results. Below. Free price estimates from local Pest Control Companies. Tell us about your project and get help from sponsored businesses. Yelp. Look for Quality and Value when choosing a pest control company, just like you do for any other purchase in your daily life. Costs and expertise are essential. The Today's Homeowner team has researched some of the top pest control companies in Warren to help you make the right decision.

Best Pest Management Inc - phone number, website, address & opening hours - Disinfecting & Deodorizing, Pest Control Services. Our Verdict. We chose Orkin and Terminix as our top picks for pest control because of their extensive experience in pest management and extermination. Both. Best Pest Control is a local company, family-owned and operated. Together, we have decades of experience in dealing with the bugs, rodents, and other pests. Best Pest Control Company In Aurora, Colorado. If you're on the search for the best pest control company in Aurora, contact EnviroPest today. One of. 1 Best Pest Control - Single treatment & preventive service for residential and commercial pest control. Ants, bed bugs, beetles, cockroaches. Pest Control in Bay City, MI - Best Pest and Animal Control | Are you dealing with pesky pests & animals? We can help you keep your home and business free. Although we are a small and young company, we strive to provide natural pest control services that are safe for the environment, surrounding wildlife, and your. We've done the research for you and put together our list of the best pest control companies for For immediate, effective solutions, the exterminator team at All Green Pest Control in Burnaby BC is your best choice. For about a decade now, we have provided. 1. Pest Control Ottawa Inc. Customer Reviews · 2. GO! Pest Control; Customer Reviews · 3. Pest Patrol Ottawa; Customer Reviews · 4. Orkin Canada Pest Control. Rod's Best Pest Control of Somerville, MA, offers quality pest control services to keep your home vermin-free. We show bugs the door! Call now. "Century is a good pest control company. Their office staff is vet professional and return calls timely. Their field techs chase down the insects for their. Despite these issues with some customers, Terminix is our choice for the best overall pest control company for most homeowners due to its widespread. The 5 Best Pest Control Services in Edmonton · Major Pest Control Edmonton · Savvy Pest Control · Geo Pest Control Inc · Professional Pest Management · Golden Arrow. I've worked as a superintendent in 4 different buildings. Pest End has clearly been the most thorough. I've seen other companies play "chase the roaches." I. Mr. Jehangir Khan is the founder and owner of the company, and he has over 18 years of experience in the industry. Ideal Pest Control methods are time tested. US Best Pest Control is a fully licensed and insured Pest Control company. We utilize the most effective pest control techniques in the aim of protecting. perfect. If you are searching for a pest control company that offers environmentally friendly products and honest communication, it's us! Put your trust in. The best pest control companies in the Bay Area · Alley Cat · Banner Pest Control. Best of the Bay Finalist Curator's Pick · Clark Pest Control. Best of the Bay. 1 Best Pest Control - Single treatment & preventive service for residential and commercial pest control. Ants, bed bugs, beetles, cockroaches.

Adidas For Prada

The White/Black colorway of the adidas Superstar Prada features an upper crafted from premium white leather, with texture and ridges on the toebox. Premium. adidas for Prada re-source is a first-of-its-kind NFT project featuring creator-owned art, in collaboration with digital artist Zach Lieberman. Mixing style and performance, the boot features adidas' innovative Speedframe technology incorporated in a light sole designed for responsive acceleration. Shop adidas Superstar x Prada Shoes 'Silver White' FX at KICKS CREW — your go-to for authentic, stylish sneakers. Whether for fashion, performance. Shop the Prada X Forum High 'Core Black' and discover the latest shoesadidas from Adidas and more at Flight Club, the most trusted name in authentic. Shop adidas x Prada Superstar sneakers. Prada and adidas trade design sensibilities across a range of sneaker icons. The Superstar and Forum High are reworked with removable zipper pouches and metal. The Copa Pure boot, mixing the stylistic codes of Prada and adidas, shines with its silver metallic leather upper and is completed by a leather flap. Prada x adidas Forum Sneakers. Size: 10 - Uk Est. Retail $ - Price: $ 20% Off Use Code REAL. The White/Black colorway of the adidas Superstar Prada features an upper crafted from premium white leather, with texture and ridges on the toebox. Premium. adidas for Prada re-source is a first-of-its-kind NFT project featuring creator-owned art, in collaboration with digital artist Zach Lieberman. Mixing style and performance, the boot features adidas' innovative Speedframe technology incorporated in a light sole designed for responsive acceleration. Shop adidas Superstar x Prada Shoes 'Silver White' FX at KICKS CREW — your go-to for authentic, stylish sneakers. Whether for fashion, performance. Shop the Prada X Forum High 'Core Black' and discover the latest shoesadidas from Adidas and more at Flight Club, the most trusted name in authentic. Shop adidas x Prada Superstar sneakers. Prada and adidas trade design sensibilities across a range of sneaker icons. The Superstar and Forum High are reworked with removable zipper pouches and metal. The Copa Pure boot, mixing the stylistic codes of Prada and adidas, shines with its silver metallic leather upper and is completed by a leather flap. Prada x adidas Forum Sneakers. Size: 10 - Uk Est. Retail $ - Price: $ 20% Off Use Code REAL.

adidas and Prada come together to present two brand new colorways of the A+P LUNA ROSSA 21 sneakers.

The adidas for Prada A+P Luna Rossa 21 returns in black and gray. Available July Inspired by sailing and a shared legacy of sporting excellence. Adidas Prada x Re-Nylon Forum High BLACK SHOES Mens sz Condition is New with box. Shipped with USPS Priority Mail. The adidas x Prada Tetracube installation at ComplexCon featured two robotic arms of rubix cube-esque LED sculptures and Megapixel's proprietary rec Adidas Prada — Cleats For the worldwide reveal of Adidas and Prada's latest collaboration, a pair of cleats, Attitude Studio tasked us with the creation and. A partnership of heritage, technology, and innovation. Introducing Prada for adidas: a shared journey that begins in December Shop our Adidas - Prada x Superstar 'White Black' ( US) at up to 80% off retail. Free US shipping. Authenticity guaranteed.- Item # Football players can now zoom and zip across the field in style thanks to the new Adidas and Prada boot collaboration. Shop new & used adidas Prada x Superstar Core Black. Authenticity Guaranteed on shoes over $ Huge inventory & free shipping on many items at adidasultraboostsneakers.site Adidas Prada Forum Low Sneaker. $ Size: (US). + Add to Bag. Details. Color: White. Size: (US). Product Condition? Fair Overall Condition. Find every Prada X Adidas item all in one place. Browse a huge selection of pre-owned fashion items at the online reseller Vestiaire Collective. Discover the Prada Superstars and buy the classic adidas style created by Prada footwear specialists in Italy now. Introducing adidas for Prada re-source: a first-of-its-kind NFT project featuring creator-owned art, in collaboration with digital artist Zach Lieberman. Shop on-sale ADIDAS X PRADA Superstar leather sneakers for Man. Browse the best deals from ADIDAS X PRADA and luxury fashion at The Outnet. These silver adidas X Prada Superstar leather sneakers feature a round toe, front lace-up fastening, low top design, signature 3-stripe, flat rubber sole. TETRACUBE | Adidas x Prada Re Nylon | This project was conceptualized in collaboration with DotDotDash. The project is composed of. The iconic Predator Accuracy boot by adidas has been reimagined for the first time with a nubuck finish and is enhanced with adidas Fusion Skin for a light. Shop Women's Adidas Superstar Prada Shoes. 99 items on sale from $ Widest selection of New Season & Sale only at adidasultraboostsneakers.site Shop the most-wanted Adidas × Prada pieces. Explore the collaboration and shop rare and recently dropped styles. Celebrating timeless design and championing future consciousness through the adidas for Prada Re-Nylon collection. A Prada shoe with adidas branding for $ is pretty good, I'm not happy about it but I'm not going to complain either.

Self Directed Ira Meaning

A self-directed IRA is a tax-advantaged retirement plan that lets you invest in a wider range of assets than standard retirement plans. Self-directing your. A Self Directed Retirement Account, or SDRA, is a term used to describe a defined contribution plan, or rather a retirement account which is able to be invested. A self-directed IRA is a powerful wealth-building tool with many advantages, including expanding your investment options while reducing or eliminating taxes. A self-directed Individual Retirement Account (IRA) is a retirement savings account that provides individuals with greater control over their investment. Fiction: A third-party custodian has a fiduciary duty to clients meaning it has the investor's best interests in mind. investment in a self-directed IRA. Self-directed investing lets you trade securities on your own with total control. Invest with a self-directed brokerage account. A Self-Directed SEP IRA is a special type of defined contribution pension plan that allows employers to contribute to Traditional IRAs (SEP-IRAs) on behalf of. A self-directed IRA is a tax-advantaged retirement plan that lets you invest in a wider range of assets than standard retirement plans. Self-directing your. The Self-Directed IRA structure allows you to hold any other investment asset you can imagine, other than these few exceptions. Which means it is possible to. A self-directed IRA is a tax-advantaged retirement plan that lets you invest in a wider range of assets than standard retirement plans. Self-directing your. A Self Directed Retirement Account, or SDRA, is a term used to describe a defined contribution plan, or rather a retirement account which is able to be invested. A self-directed IRA is a powerful wealth-building tool with many advantages, including expanding your investment options while reducing or eliminating taxes. A self-directed Individual Retirement Account (IRA) is a retirement savings account that provides individuals with greater control over their investment. Fiction: A third-party custodian has a fiduciary duty to clients meaning it has the investor's best interests in mind. investment in a self-directed IRA. Self-directed investing lets you trade securities on your own with total control. Invest with a self-directed brokerage account. A Self-Directed SEP IRA is a special type of defined contribution pension plan that allows employers to contribute to Traditional IRAs (SEP-IRAs) on behalf of. A self-directed IRA is a tax-advantaged retirement plan that lets you invest in a wider range of assets than standard retirement plans. Self-directing your. The Self-Directed IRA structure allows you to hold any other investment asset you can imagine, other than these few exceptions. Which means it is possible to.

Contributions are tax-deferred, meaning you can deduct them. Individuals only pay taxes once they withdraw from their accounts. With a SIMPLE IRA, employees can. In , as part of the Employee Retirement Income Security Act of (ERISA) and the creation of IRAs, self directed IRAs were also permitted. At that time. Most conventional IRAs are *self-managed* meaning that you can buy/sell/pick your own investments that your broker (eTrade) allows. Whereas, in. The IRA LLC is also known as the Checkbook IRA and it' s great solution to taking back control of your retirement funds. Self-Directed IRAs have been around. A self-directed IRA, which can be a traditional IRA or Roth IRA, allows the account owner to make investment decisions. Self-directed IRAs are helpful since. A self-directed IRA (SDA) is an IRA that allows the IRA owner to pick the investments. Because the IRA trustee or custodian does not pick the investments, the. An IRA that allows the individual to select the investment options that best fit their investment objectives. The investment choices include stocks, bonds. Most conventional IRAs are *self-managed* meaning that you can buy/sell/pick your own investments that your broker (eTrade) allows. Whereas, in. Self-directed investing from U.S. Bancorp allows you to trade stocks, mutual funds, exchange-traded funds (ETFs) and options yourself, directly online. A self-directed IRA is a type of retirement account that allows you to invest in a wide variety of investments, such as real estate, private businesses, and. A self-directed IRA is a type of traditional or Roth IRA, meaning it allows you to save for retirement on a tax-advantaged basis, says Lori Gross, financial and. In , as part of the Employee Retirement Income Security Act of (ERISA) and the creation of IRAs, self directed IRAs were also permitted. At that time. “Self-directed” essentially means that the IRA (or plan) owner or someone the IRA Owner appoints, makes all the investment choices and decisions for their IRA. Self-directed individual retirement accounts (IRAs) are excellent accounts that allow you to invest your retirement funds into alternative assets like. The Self-Directed IRA LLC gives you complete control over your retirement. Invest in traditional and alternative investments by simply writing a check. A self-directed IRA allows for alternative investments, and investors have more say in the types of assets that the IRA holds. While regular IRAs hold stocks. Self-directed investing from U.S. Bancorp allows you to trade stocks, mutual funds, exchange-traded funds (ETFs) and options yourself, directly online. A Self-Directed IRA is a regular IRA that has a world of investment opportunities. No longer are you limited to what your local bank or the popular online sites. What the self-directed IRA custodian does is execute investment directions from the IRA owner and perform the many custodial and administrative duties that are. A Self-Directed IRA is a regular IRA that has a world of investment opportunities. No longer are you limited to what your local bank or the popular online.

Harry Dent New Book

Harry S. Dent, Jr. is the author of the New York Times bestseller The Great Depression Ahead among many other economic and financial books. Harry S. Dent Jr., bestselling author of The Demographic CliffandThe Sale of a Lifetime, predicted the populist wave that has driven the Brexit vote, the. In , Harry published his latest book Spending Waves, where he shares decades of extensive research covering over businesses across 14 different. He is a Fortune consultant, small business manager, new venture investor, and noted speaker and has a Harvard MBA. He stood virtually alone in forecasting. A Harvard MBA, Fortune consultant, new venture investor, noted speaker and bestselling author, Harry S. Dent, Jr. is the founder and senior editor at. A best-selling author, Harry has written numerous successful books over the years, including The Demographic Cliff – How to Survive and Prosper During the. Books by Harry S. Dent Jr. · The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in · Great Boom Ahead: Your Guide to Personal &. He has also written numerous successful and award-winning books over the years. His New York Times best sellers include The Sale of a Lifetime (), The Great. Harry S. Dent Jr. has 32 books on Goodreads with ratings. Harry S. Dent Jr.'s most popular book is The Demographic Cliff: How to Survive and Prosper. Harry S. Dent, Jr. is the author of the New York Times bestseller The Great Depression Ahead among many other economic and financial books. Harry S. Dent Jr., bestselling author of The Demographic CliffandThe Sale of a Lifetime, predicted the populist wave that has driven the Brexit vote, the. In , Harry published his latest book Spending Waves, where he shares decades of extensive research covering over businesses across 14 different. He is a Fortune consultant, small business manager, new venture investor, and noted speaker and has a Harvard MBA. He stood virtually alone in forecasting. A Harvard MBA, Fortune consultant, new venture investor, noted speaker and bestselling author, Harry S. Dent, Jr. is the founder and senior editor at. A best-selling author, Harry has written numerous successful books over the years, including The Demographic Cliff – How to Survive and Prosper During the. Books by Harry S. Dent Jr. · The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in · Great Boom Ahead: Your Guide to Personal &. He has also written numerous successful and award-winning books over the years. His New York Times best sellers include The Sale of a Lifetime (), The Great. Harry S. Dent Jr. has 32 books on Goodreads with ratings. Harry S. Dent Jr.'s most popular book is The Demographic Cliff: How to Survive and Prosper.

In , he published his latest book, “Spending Waves,” where he shares decades of extensive research covering over businesses across 14 different. Harry S. Dent Jr., bestselling author of The Demographic CliffandThe Sale of a Lifetime, predicted the populist wave that has driven the Brexit vote, the. Harry Dent is predicting an 86% stock market crash next year. Scared? Well, his track record says it all. In , he predicted prosperity;. He is the author of the New York Times bestseller, The Great Depression Ahead, as well as of The Great Boom Ahead, in which he stood virtually alone in. Read more about The Great Boom Ahead: Your Comprehensive Guide To Personal And Business Profit In The New Era Of Prosperity and other books by Harry S. Dent, Jr. In , Harry published his latest book Spending Waves, where he shares decades of extensive research covering over businesses across 14 different. In his latest book, The Next Great Bubble Boom, he offers a comprehensive forecast for the next two decades and explains how fundamental trends suggest. Harry Dent is the author of the successful book release, The Great Boom Ahead and publishes the H. S. Dent Forecast. His second book, Job Shock: Four New. Available in: Audiobook (Digital).In this nine session course from Harry Dent, you learn what to expect in the winter economic season and the best business. Harry S. Dent From the upcoming wealth revolution to the essential principles of entrepreneurial success, the book describes a new society where economic and. Zero Hour: Turn the Greatest Political and Financial Upheaval in Modern History to Your Advantage · Harry S. Dent Jr. · Andrew Pancholi · Will you be prepared to. Harry Dent is predicting an 86% stock market crash next year. Scared? Well, his track record says it all. In , he predicted prosperity;. Abraham A. Hale Abraham A H Harry Dent's Market Crash Predict (Taschenbuch) ; Condition. Brand New ; Item Number. ; Accurate description. Harry Dent. likes · 2 talking about this. Harry S. Dent, Jr. is an American financial newsletter writer. His book, The Great Depression A. Harry has written numerous books over the years. In his book The Great Boom Ahead, published in , he stood virtually alone in accurately forecasting the. On today's Rant Harry Dent is reading the signs pointing to the crash in the markets and discussing what needs to happen next to confirm we have finally reac. Harry S. Dent, Jr. is an American financial newsletter writer. His book, “The Great Depression Ahead”, appeared on the New York Times Bestseller List. Harry Dent made a name for himself in his earlier years predicting major market moves such as the Japanese slow down and the Tech wreck. "You can't accuse Harry Dent of being a wimpy thinker. His new book is full of confident analysis and bold predictions. Whether he will be right about all. Harry authored popular book “The Demographic Cliff.” Learn what Harry thinks about demographics, markets, and cash-flowing real estate in the turmoil ahead.